SBI

Gold Loan Calculator

Why choose

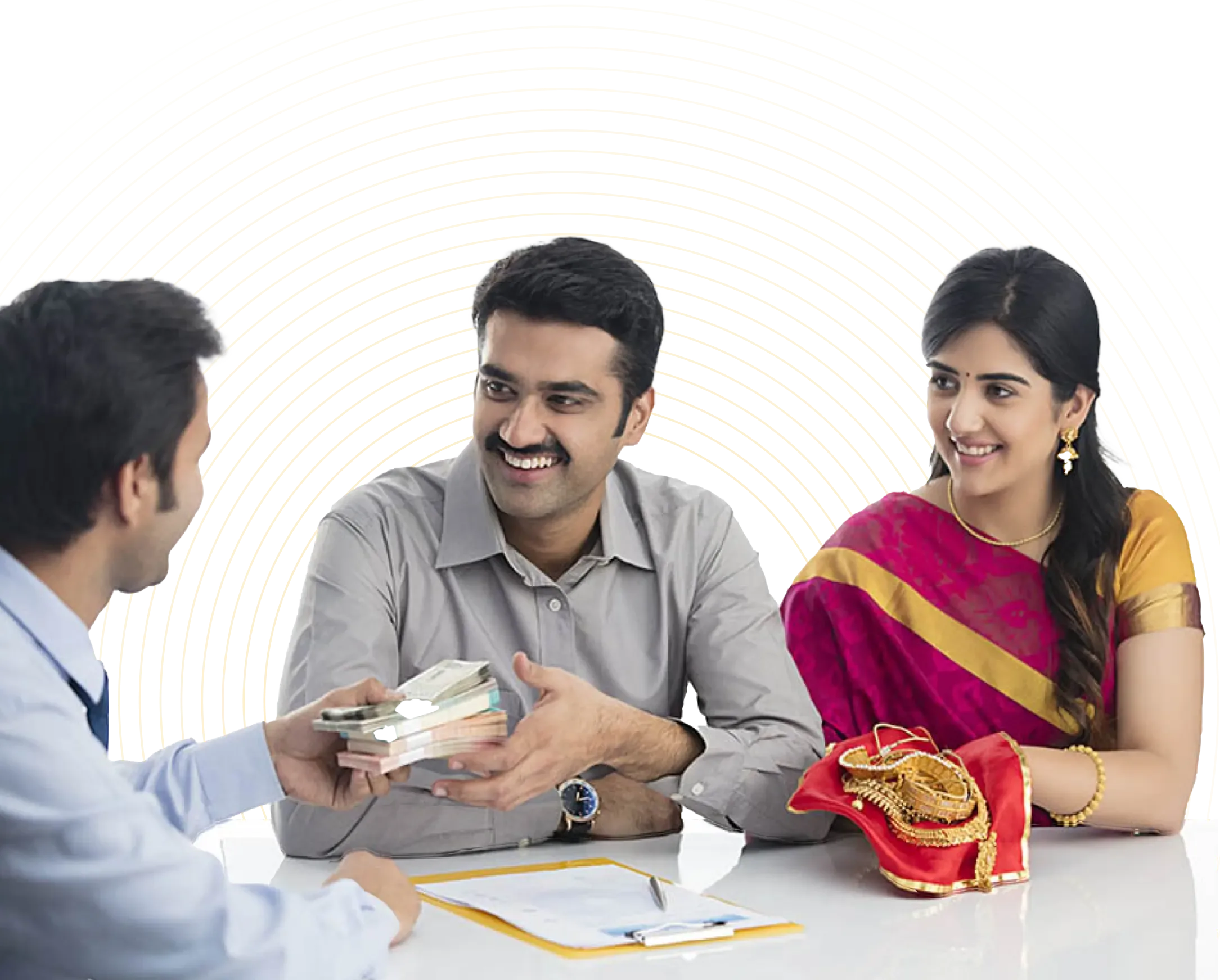

Trusted by over 20 Lakh customers, indiagold provides instant gold loans and secure gold locker services across India

Easy Repayment Options

Indiagold not only offers one of the lowest gold loan interest rate in India, but also offers the borrowers with hassle free repayment plans. This goes a long way from the borrower’s perspective as it gives them the headspace to pay off the loan more efficiently while utilizing the funds secured from the gold loan to its full potential.

Post Loan Settlement Convenience

Collateral release as fast as securing a loan! IndiaGold offers high convenience to the customers in the form of quick release, ensuring that the borrowers get the highest convenience even after closing the loan account.

High Borrowing Potential

indiaGold offers one of the highest Loan to Value (LTV) offered by the lenders. This enables the borrowers to secure a maximum amount of loan against their collateral!

Instant Disbursal

IndiaGold offers instant disbursal, the entire process of obtaining a gold loan is extremely quick and efficient, enabling the lender to disburse funds in under 30 minutes!! Talk about efficiency!

Low Documentation Requirement

Unlike some other loans available in the market, gold loan documents requirement is pretty low. The reason being the fact that these types of loans are backed by collateral, i.e. your gold. Hence, the entire process of obtaining the loan, including the documentation process is pretty straightforward and less time consuming.

How is Gold Loan EMI Calculated?

LENDING PARTNERS

Benefits of Gold Loan Calculator

Features of Gold Loan

Factors affecting Gold Loan interest Rate

The interest rate for a gold loan is based on several factors, including:

Conclusion

By having the important variables such as the interest rate and the loan amount, people can easily see the details of the loan, including how much is repaid. It is a better understanding of what is repaid and will enable people to make improved financial decisions.

Gold loans are also unique due to their distinguishing features. Being collateral-based loans, they are prone to being charged lower rate of interest and lower terms like no credit score check. Low processing fee and negotiable repayment terms are also offered to the borrowers. Some lenders in the India gold loan market disburses loans on the spot and offer free cover insurance up to 100% of the gold pledged with indiagold being the prime example. That is one additional security for the borrowers.

On the whole, the Gold Loan Calculator is a wonderful calculator to make lending a simpler affair and enable individuals to understand what the loan agreement is all about and make the necessary decisions.